As an all-encompassing discussion of the industry present and future, the FUTURE50 panel lineup wouldn't be complete without an expert-driven talk on the second-largest beauty market: China. Home to some of the most innovative brands and retail concepts, the region remains an intriguing landscape, but with slowing growth and struggles for international brands, growth doesn’t come easy. In 2023, the Chinese beauty market registered a modest 5.1% growth, reaching $58 billion, according to data from the National Bureau of Statistics of China.

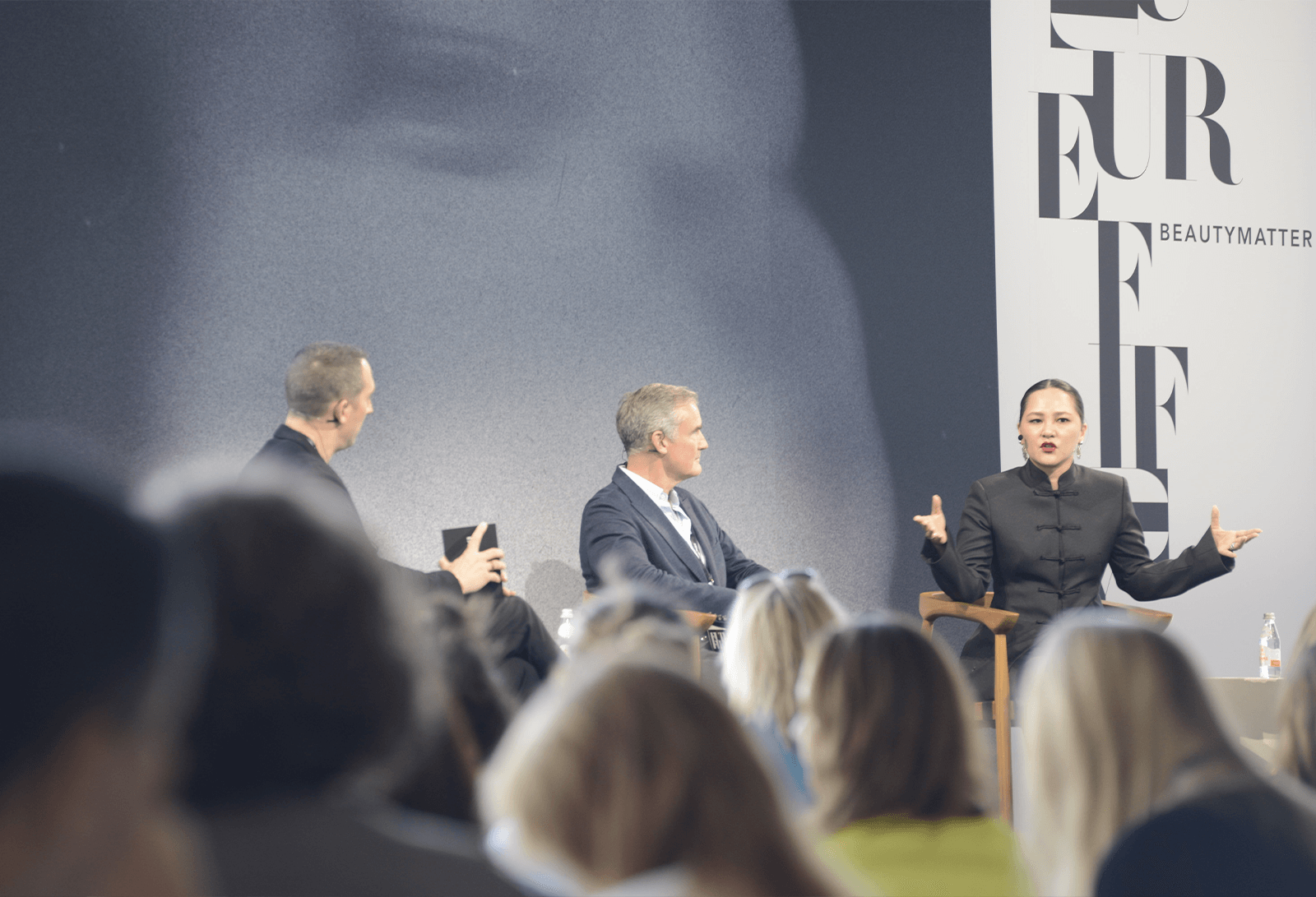

John Cafarelli, President of BeautyMatter, spoke to Gabby Chen, President of Global Expansion, Florasis; Charlie Gu, Head of Jing Intelligence, Jing Daily; and Charles Denton, Chairman of Erno Laszlo about the realities of entering and prospering in an increasingly competitive market, which is set to hit $96 billion by 2027, according to McKinsey.

Denton, who helped lead the Erno Laszlo brand to a primary spot in the market—ranking number two on Chinese TikTok, going from 0 to a $50 million business in less than 18 months, having been an early entrant to the prestige masking category—reflected on the evolution of the market.

“You used to put a dollar down and earn three. But the Chinese market is always in a state of change. Six months in China is the equivalent to three years in America. The players have changed; they were dominated by Western brands, but the local brands have learned from consumers. It’s not an efficient market anymore; now you lose money on your acquisition. Traditionally you would have three or four ways to get into market, but the distributor model is difficult to justify today,” he explains.

Gu dove into the trends driving consumer interest. “Now more and more consumers are shifting from pleasing others to self-indulgence. It’s all about how to make yourself happy, which is especially evident in the fast-growing fragrance category,” he notes, citing the new five senses (originality, presence, atmosphere, socialization, looseness) as key drivers. Gu emphasized the Loewe Crafted World Exhibition at Shanghai Exhibition Centre as a highlight of a brand using these drivers to their advantage.

As the quintessential C-beauty makeup brand that has achieved viral status and sustained growth worldwide ($850 million in annual sales) for its quality formulations, intricate packaging, and outsized marketing experiences, Florasis is a shining example of the homegrown beauty market. The brand was founded in 2017 as an expression of proud identity. “We are not trying to sell a lipstick. We infuse Chinese elements around history, heritage, traditional Chinese medicine (TCM), and aesthetics to create a modern brand,” she explained.

Denton spoke to the challenges and advantages that foreign brands face when confronted with homegrown talent. “The advantage of Chinese brands is that they take data very seriously, and their speed/ability to jump on a trend and act is remarkable. The disadvantage is they struggle to take a risk and see into the future, but they have an understanding of the consumer, and with their high degrees of efficacy and claims, they are winning the scientific argument,” he commented.

Gu adds, “Western brands are continuing to unlock growth in China. We have reached a watershed moment where the playing field has leveled. There used to be this halo effect of Western brands but that has gone. Part of it is understanding that there is a cultural confidence behind consumers with Chinese brands. It’s not just about data but the unique lifestyle and the way they use beauty.” He cited UNICSKIN reformulating their product line to appeal to post-med-spa procedure customer as one example.

The topic of conversation shifted to the distribution landscape, encompassing Tmall, Douyin, and Little Red Book, as well as physical retail stores such as Florasis’ flagship experiential presence in Hangzhou. Chen noted that while foreign brands start on Tmall, traffic and campaigns have become too expensive making it a no longer profitable platform, turning them towards the physical retail experience to help brand positioning (whereas in only spaces, the only way the customer can feel the brand is through price).

Denton describes a symbiosis between digital and physical retail where key touchpoints reinforce each other but have different reasons to exist. He describes Tmall as a trusted point of difference, Little Red Book as a helpful peer review site (for which he sees massive reinvention potential in the future), in-store experiences as ways to feel and learn about the brand, and Douyin as a source of edutainment (it is also the space in which Erno Laszlo entered as the first premium skincare brand). Brand advisors, which the company refers to as BFs, are also on-hand to help build trust with the customer. Gu proclaimed, “Physical retail is very important but not for what you think it is. The store is your canvas to tell our story in a very controlled manner.” Chen added, “For C-beauty brands, it’s about the culture experience.”

When asked if C-beauty has the potential to become the new K-beauty, Gu summarized, “I wouldn’t compare them, but I am confident that the C-beauty brands will succeed. Thanks to the Chu culture of refinement and heritage, combined with the rich history with innovation and Chinese supply chain, C-beauty has a lot to offer.”

Key Takeaways: